Artificial Intelligence has rapidly become a game-changer in various industries, with financial services being one of the most impacted. The integration of AI into financial services has reshaped how financial institutions operate, offering improved efficiency, better customer experiences, and solutions to complex problems.

This article explores the multifaceted applications of AI in financial services, including its role in financial analysis, investment banking, and fintech.

How Does AI in Financial Services Operate?

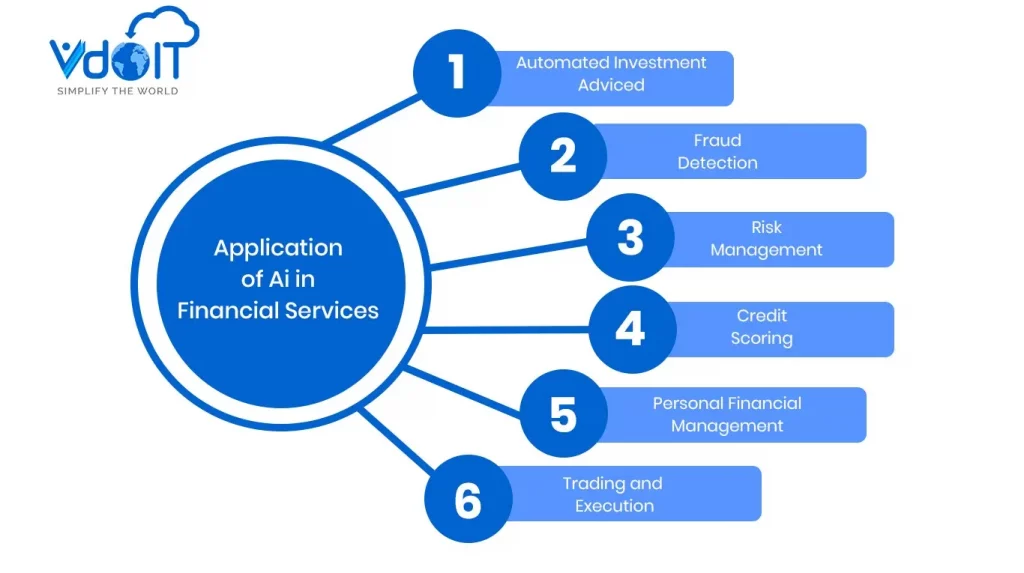

AI in financial services encompasses a broad range of applications, from automated customer service to advanced financial modeling. Financial institutions are leveraging AI to enhance decision-making processes, manage risks, and streamline operations. Key areas where AI is making a significant impact include:

Customer Service and Support

AI-powered chatbots and virtual assistants provide 24/7 support, answering customer queries, resolving issues, and guiding them through various financial products and services.

Fraud Detection and Prevention

AI algorithms analyze transaction patterns in real-time to detect and prevent fraudulent activities, reducing financial losses and enhancing security.

Risk Management

AI models assess risk by analyzing vast amounts of data, enabling financial institutions to make informed decisions and minimize potential losses.

Personalized Banking

AI analyzes customer data to offer personalized financial advice, product recommendations, and tailored solutions, enhancing the overall customer experience.

Alt text: Application of AI in Financial Services including – automated investment, fraud detection, risk management, credit scoring, personal financial management, trading and execution.

AI for Financial Analysis

Financial analysis is a critical component of the financial services industry, involving the evaluation of financial data to make informed decisions. AI enhances financial analysis by automating data collection, processing, and interpretation, thus providing more accurate and timely insights.

Did You Know? As per McKinsey, About 70 percent of banks and other institutions with highly centralized gen AI operating models have progressed to putting gen AI use cases into production.

Key applications of AI in financial analysis include:

Automated Data Processing

AI algorithms process large volumes of financial data at unprecedented speeds, reducing the time and effort required for manual data analysis.

Predictive Analytics

AI uses historical data to predict future financial trends, helping analysts make more informed investment decisions and risk assessments.

Sentiment Analysis

AI analyzes news articles, social media, and other textual data to gauge market sentiment, providing valuable insights into market movements and investor behavior.

Portfolio Management

AI-driven tools optimize portfolio management by analyzing various assets’ performance and suggesting optimal asset allocation strategies.

Get in touch with the best Artificial Intelligence Services and AI Development Company today!

AI Financial Analysis How It’s Transforming Decision-Making

The advent of AI in financial analysis has transformed decision-making processes within financial institutions. By providing more accurate, timely, and actionable insights, AI has enabled financial analysts to make better-informed decisions. Some of the notable impacts of AI financial analysis include:

Here’s a table representing the benefits:

| Impact of AI in Financial Analysis | Description |

| More Efficient | AI algorithms reduce human error by automating data analysis, resulting in more accurate financial forecasts and assessments. |

| More Accurate | AI automates repetitive tasks, allowing analysts to focus on higher-level strategic decisions, thereby improving overall efficiency. |

| More Insightful | AI provides real-time insights into market trends and financial performance, enabling quicker and more effective decision-making. |

| More Adaptable | AI can analyze vast amounts of data from multiple sources simultaneously, making it possible to scale financial analysis efforts to accommodate larger datasets and more complex analyses. |

AI for Financial Services Innovation

AI is driving innovation across various segments of financial services, offering new opportunities for growth and development. By automating processes, enhancing customer experiences, and providing advanced analytical capabilities.

[Also Read: Role of Artificial Intelligence in Science and Technology]

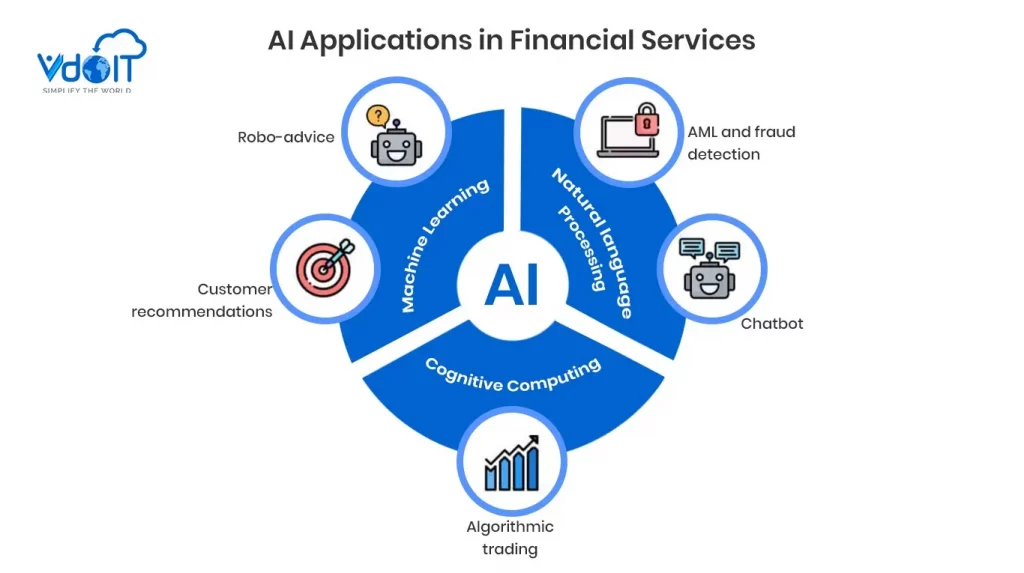

AI is helping financial institutions stay competitive in an increasingly digital world. Some of the innovative applications of AI for financial services include:

Robo-Advisors

AI-powered robo-advisors provide automated investment advice based on individual investor profiles, risk tolerance, and financial goals, making investment management accessible to a broader audience.

Algorithmic Trading

AI-driven algorithms execute trades based on predefined criteria and real-time market data, optimizing trading strategies and maximizing returns.

Credit Scoring

AI models assess creditworthiness by analyzing various data points, including non-traditional sources such as social media activity and online behavior, resulting in more accurate credit scores and improved lending decisions.

Compliance and Regulatory Reporting: AI automates compliance monitoring and regulatory reporting, ensuring adherence to financial regulations and reducing the risk of non-compliance.

AI in Investment Banking

Investment banking is another sector within financial services that has been significantly impacted by AI. From deal origination to execution, AI is transforming various aspects of investment banking, enhancing efficiency and accuracy. Key applications of AI in investment banking include:

Deal Sourcing and Origination

AI algorithms analyze market data to identify potential investment opportunities, helping investment bankers source and originate deals more effectively.

Due Diligence

AI automates the due diligence process by analyzing financial statements, legal documents, and other relevant data, reducing the time and effort required for manual reviews.

Valuation and Modeling

AI enhances financial modeling and valuation by processing large datasets and identifying patterns, resulting in more accurate and reliable valuations.

Risk Assessment

AI models assess the risks associated with various investment opportunities, enabling investment bankers to make more informed decisions and mitigate potential risks.

Alt text: AI Applications in Financial Services (Part II) – Robo advice, AML and Fraud Detection, Customer Recommendations, Algorithmic Trading, and Chatbot functions.

Artificial Intelligence in Fintech

Fintech, the fusion of finance and technology, has been at the forefront of AI adoption in the financial services industry. AI is driving innovation in fintech by providing new solutions to traditional financial challenges and creating new business models. Some of the notable applications of artificial intelligence in fintech include:

- Payment Processing: AI streamlines payment processing by automating transactions, detecting fraud, and ensuring secure and efficient payment systems.

- Lending Platforms: AI-powered lending platforms use advanced algorithms to assess creditworthiness, automate loan approvals, and offer personalized loan products to consumers and businesses.

- Insurtech: AI enhances insurance services by automating claims processing, underwriting, and customer service, resulting in faster and more efficient insurance operations.

- Blockchain and Cryptocurrencies: AI analyzes blockchain data to identify trends, detect anomalies, and provide insights into cryptocurrency markets, helping investors make informed decisions.

Challenges and Considerations

While AI offers numerous benefits to the financial services industry, it also presents several challenges and considerations. Financial institutions must address these challenges to fully realize the potential of AI. Key challenges and considerations include:

- Data Privacy and Security: AI relies on vast amounts of data, raising concerns about data privacy and security. Financial institutions must implement data protection measures to safeguard sensitive information.

- Regulatory Compliance: The use of AI in financial services is subject to regulatory scrutiny. Financial institutions must ensure compliance with relevant regulations and standards to avoid legal and reputational risks.

- Bias and Fairness: AI algorithms can perpetuate biases present in historical data, leading to unfair outcomes. Financial institutions must ensure that their AI models are fair and unbiased.

- Transparency and Explainability: AI models can be complex and difficult to understand, raising concerns about transparency and explainability. Financial institutions must ensure that their AI models are transparent and explainable to build trust with customers and regulators.

- Ethical Rules: The use of AI in financial services raises ethical considerations, including the potential for job displacement and the impact on customer relationships. Financial institutions must address these ethical considerations to ensure the responsible use of AI.

What Lies in the Future of AI in Financial Services

The future of AI in financial services is promising, with ongoing advancements in technology and increasing adoption across the industry. Financial institutions are expected to continue leveraging AI to drive innovation, enhance efficiency, and improve customer experiences.

Some of the key trends shaping the future of AI in financial services include:

- AII-Driven Personalization: Enhances personalized banking experiences with tailored financial advice, products, and services based on individual preferences and behaviors.

- Advanced Risk Management: Enables better prediction and mitigation of risks for financial institutions.

- Integration with Emerging Technologies: Integrates AI with blockchain, IoT, and quantum computing to create new solutions and business models.

- Enhanced Regulatory Compliance: Automates compliance processes and provides real-time monitoring and reporting.

- Ethical AI Development: Focuses on creating fair, transparent, and explainable AI models to ensure responsible use and build trust.

To A Better and Smarter Finance Industry

AI is transforming the financial services industry, offering numerous benefits and opportunities for innovation. By enhancing efficiency, improving decision-making processes, and providing personalized customer experiences, AI is helping financial institutions stay competitive in an increasingly digital world.

However, financial institutions must address the challenges and considerations associated with AI to fully realize its potential. The future of AI in financial services is promising, with ongoing advancements and increasing adoption expected to drive further innovation and growth in the industry.

For Artificial Intelligence Services and AI Development Company that can help your financial entity grow, contact VDOIT Technologies today!

FAQs : AI in Financial Services

How is AI used in financial services?

AI in financial services is used for risk management, fraud detection, customer service automation, and predictive analytics. It enhances decision-making through data analysis, personalized customer experiences, and optimizes trading strategies. AI also streamlines compliance processes and improves operational efficiency

How is AI used in fintech?

AI in fintech powers robo-advisors, automates loan approval processes, and enhances payment systems. It provides personalized financial recommendations, detects fraudulent activities, and improves customer onboarding. AI also enables efficient credit scoring, risk assessment, and facilitates algorithmic trading.

What are the benefits of generative AI in financial services?

Generative AI in financial services enables automated report generation, personalized financial advice, and enhanced customer interactions. It streamlines content creation for marketing, accelerates data analysis, and improves decision-making by simulating market scenarios.

What are some AI in financial services examples?

AI in financial services includes fraud detection systems, robo-advisors for investment management, AI-driven customer support chatbots, predictive analytics for credit scoring, and algorithmic trading platforms. Moreover, AI is used in anti-money laundering (AML) monitoring, personalized financial product recommendations, and risk assessment tools.

How do Finance AI chatbots help?

Finance AI chatbots assist by providing 24/7 customer support, answering queries, guiding users through transactions, and offering personalized financial advice. They automate routine tasks, improve response times, and enhance customer satisfaction while reducing operational costs for financial institutions.